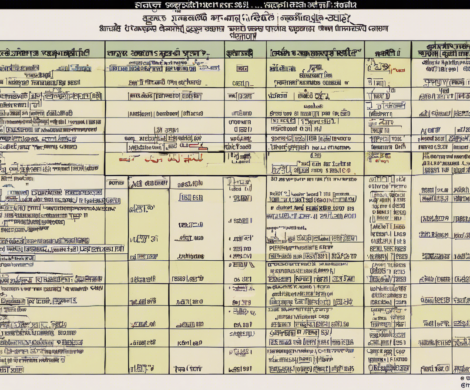

Maxposure IPO Subscription Status Updates

In the dynamic world of finance, Initial Public Offerings (IPOs) hold a significant allure for both seasoned investors and newcomers to the market. The process of a company going public and offering its shares to the public for the first time can generate a great deal of excitement and interest. One key aspect that investors closely monitor during an IPO is the subscription status. This update provides vital information on the demand for the company’s shares and can offer insights into investor sentiment and the potential future performance of the stock.

What is an IPO Subscription Status?

The IPO subscription status is a critical metric that indicates the demand for shares offered during an Initial Public Offering. It reflects how many times the shares on offer have been applied for by investors, relative to the total number of shares available. This ratio, known as the subscription ratio, provides valuable insights into the level of interest in the IPO and helps investors gauge the potential oversubscription or undersubscription of the issue.

Understanding the Subscription Status

Companies going public announce an IPO with a specific number of shares available for subscription. During the IPO period, investors can apply for these shares at the offer price. The subscription status is updated regularly throughout the subscription period and provides details on the total number of applications received for the shares on offer.

Factors Influencing Subscription Status

Several factors can influence the subscription status of an IPO, including:

-

Company Fundamentals: The financial health, growth prospects, and overall reputation of the company offering its shares can impact investor interest.

-

Market Conditions: The overall market sentiment, prevailing economic conditions, and industry trends can also play a significant role in determining the subscription status.

-

Pricing: The offer price of the shares relative to the company’s valuation and comparable peers can influence investor appetite for the IPO.

-

Marketing and Promotions: The effectiveness of the company’s roadshows, marketing campaigns, and promotional activities can impact the subscription numbers.

Importance of Monitoring Subscription Status

For investors considering participating in an IPO, monitoring the subscription status is crucial for several reasons:

-

Demand Assessment: The subscription status provides insights into the level of demand for the IPO shares, indicating whether the offering is oversubscribed (high demand) or undersubscribed (low demand).

-

Investor Sentiment: By analyzing the subscription status, investors can gauge market sentiment towards the company and assess the potential listing performance of the stock.

-

Allocation Probability: The subscription status can offer clues on the likelihood of allotment of shares applied for, especially in case of oversubscription.

-

Risk Management: Understanding the subscription status helps investors make informed decisions regarding their participation in the IPO and manage the associated risks.

Interpreting Subscription Status

When monitoring the subscription status of an IPO, investors should consider the following aspects:

-

Subscription Ratio: A ratio above 1 indicates oversubscription, implying high demand for the shares. Conversely, a ratio below 1 signifies undersubscription.

-

Retail vs. Institutional: Monitoring the subscription status across retail and institutional categories can provide insights into different investor segments’ interest levels.

-

Trends: Tracking the subscription status over different days during the subscription period can reveal trends in investor appetite and demand dynamics.

IPO Subscription Status Updates

Throughout the subscription period, companies and stock exchanges provide regular updates on the subscription status. Investors can access this information through various channels, including the company’s website, stock exchange websites, financial news portals, and mobile applications. These updates typically include details such as the total number of shares on offer, the total number of applications received, and the subscription ratio. Additionally, companies may release periodic press releases or notifications to update investors on the subscription status.

FAQs on IPO Subscription Status Updates

- How often is the IPO subscription status updated during the subscription period?

-

The IPO subscription status is typically updated daily during the subscription period, providing investors with real-time information on the demand for the shares.

-

What does an oversubscription in an IPO indicate?

-

An oversubscription implies that the demand for the shares exceeds the number of shares available, reflecting strong investor interest in the IPO.

-

Can the subscription status of an IPO change during the subscription period?

-

Yes, the subscription status can fluctuate during the subscription period based on the influx of new applications from investors.

-

How can investors use the subscription status to make investment decisions?

-

Investors can use the subscription status to assess the demand for the IPO, determine allocation probabilities, and gauge market sentiment towards the offering before making investment decisions.

-

Are there any risks associated with relying solely on the subscription status for investment decisions?

- While the subscription status provides valuable insights, investors should consider other factors such as company fundamentals, market conditions, and valuation metrics before making investment decisions.

In conclusion, monitoring the IPO subscription status updates is an essential practice for investors interested in participating in initial public offerings. By understanding the significance of the subscription status, interpreting the data effectively, and staying informed about the latest updates, investors can make informed decisions and navigate the dynamic landscape of IPO investments with greater confidence and clarity.